|

Greater Baltimore Property Management Blog

January 2025 News Letter

August 2024 Newsletter

|

July 2024 Newsletter

NEWSLETTER

July 2024 | Issue No. 24

Check out the newest issue of our monthly e-newsletter that features our newly implemented process updates, industry-related news, and our latest blog articles.

Here's what we have for you for this month.

Maintaining a Smooth Partnership: Key Reminders

As we continue our partnership, we want to reiterate some important aspects of our management agreement to ensure smooth and efficient operations for all parties involved.

1. Communication with PropertyWize

To enhance our communication and streamline processes, we kindly remind you to utilize our dedicated Owner Portal for all communications. This ensures that we can track and address your concerns promptly. The Owner Portal is designed to keep all communication organized and ensures that your inquiries are addressed in a timely manner.

2. Tenant Interaction

To maintain a professional and harmonious relationship with tenants, please avoid contacting them directly. All communications should be routed through us to ensure consistency and avoid any potential misunderstandings. This practice helps us provide a seamless experience for both you and the tenants.

3. Property Access

As stipulated in our contract, accessing the property without advance notice is a liability issue. It is crucial to inform us prior to any visits or inspections to the property. This policy ensures the safety and privacy of the tenants and adheres to legal requirements.

We value your trust and partnership. By adhering to these guidelines, we can ensure a positive experience for everyone involved. Thank you for your continued cooperation and support.

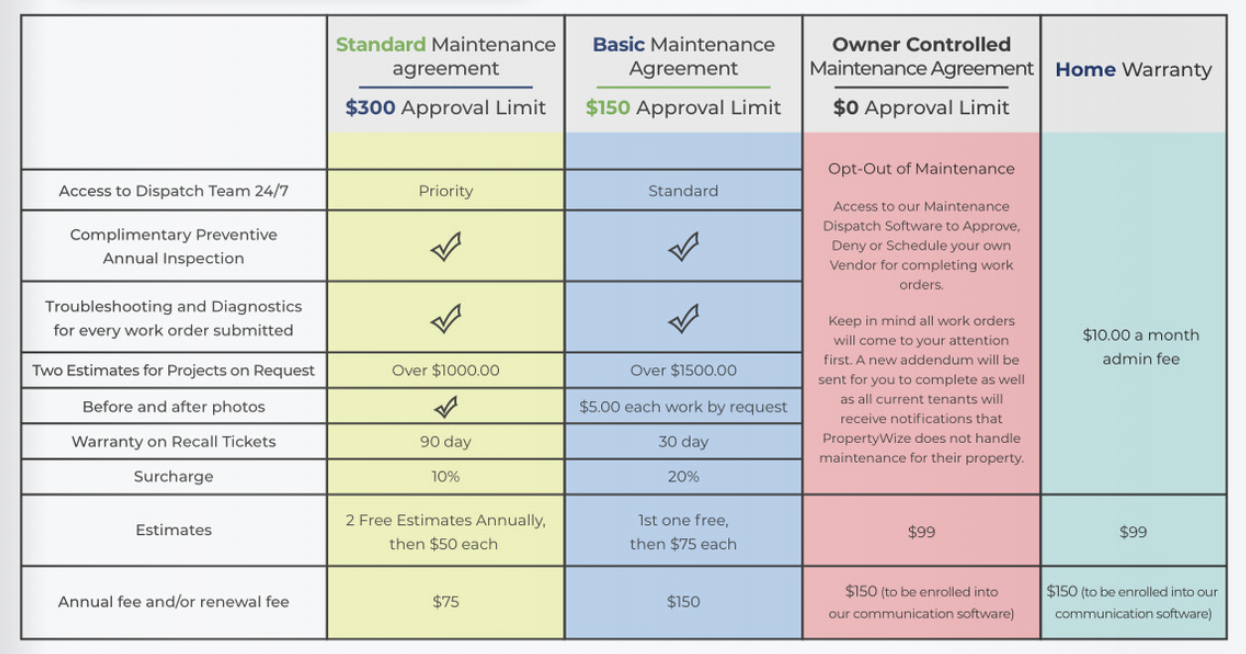

PropertyWize Maintenance Program

We would like to remind you about our comprehensive Maintenance Program, designed to preserve and enhance the value of your investment.

Our Maintenance Program offers various options tailored to your needs, allowing you to choose the level of service that best fits your property and budget.

By participating in our Maintenance Program, you help ensure a well-maintained property, satisfied tenants, and reduced turnover. For more details, please refer to our Maintenance Program Guide.

Action Required:

Please check in to confirm which option of the maintenance program you have elected to participate in. If we do not receive a response, you will be automatically enrolled in our standard plan.

Maintenance Program Guide

PropertyWize Rental Owner Statements

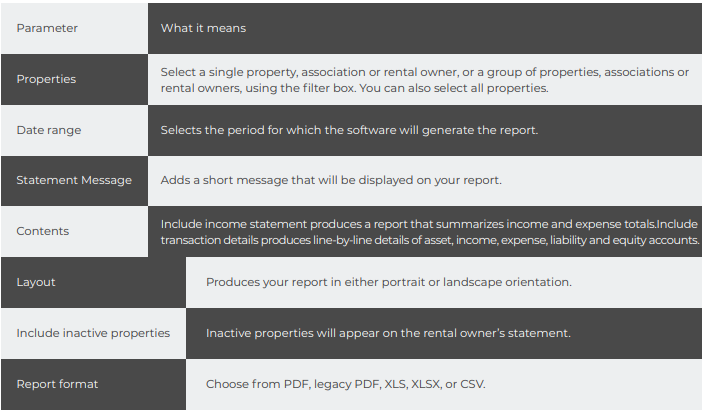

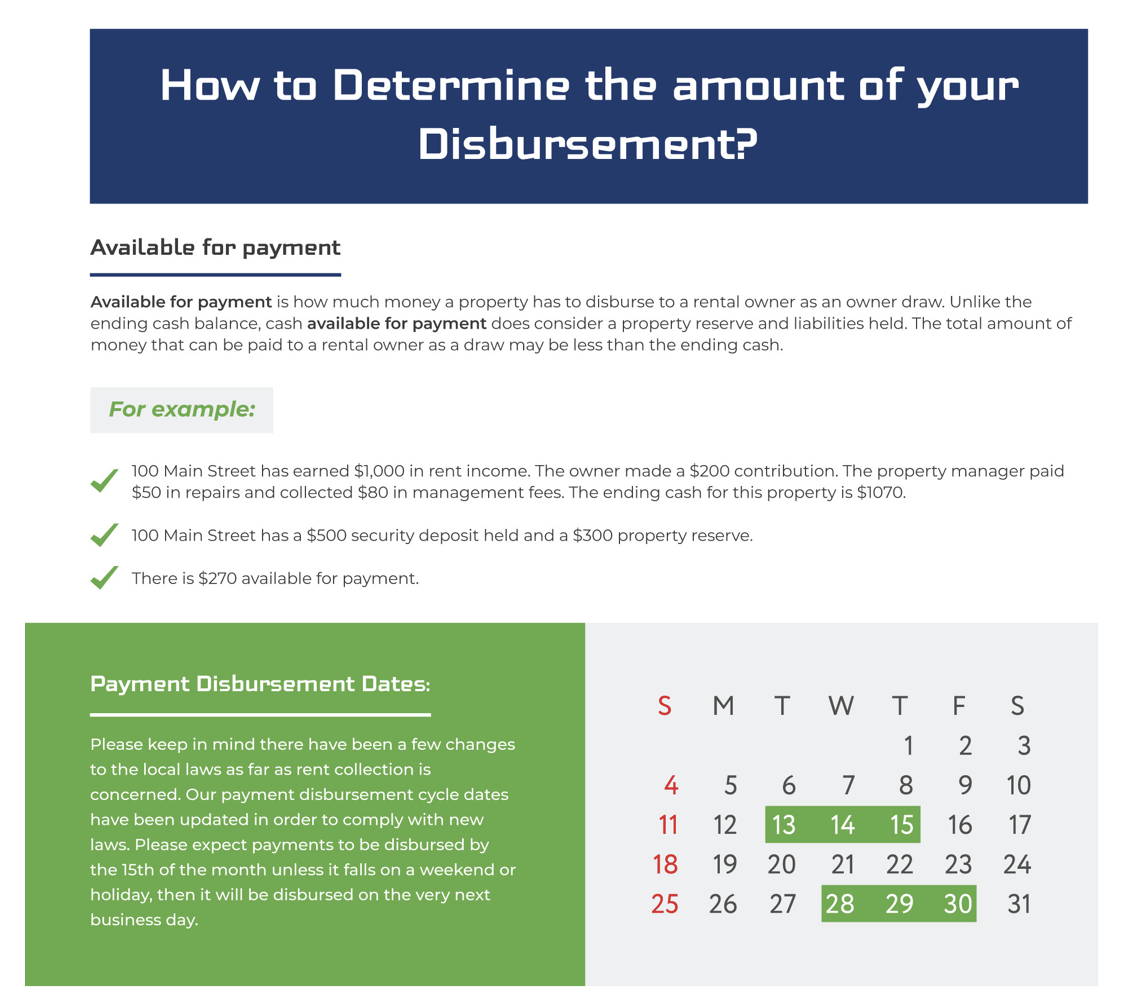

Running the rental owner statement report is very important in determining the amount of your available disbursement payment. The rental owner statement will show you all the transactions affecting the owner’s available cash. It is a great place to find missing or incorrect transactions on your rental property that will cause inaccurate information.

Some Tips When Running Owner Statement

Check the property beginning balance. At times, changes to past transactions can affect the owner’s running available for payment balance. Running a rental owner statement with a prior start date will help you find discrepancies.

Run the rental owner statement including the transaction details. Seeing more a more detailed view can also help to find discrepancies or missing transactions

When to Use It

This is the best summary report to give to a rental owner each month

Track the cash flow of the property(s)

Report liabilities held

Determine income and expenses recorded for an owner

View the amount you should pay your owners

Determine when an owner was not paid the correct amount

Important Information

The rental owner statement runs on a cash basis.

The beginning cash balance is the amount owed to/from the rental owner, less tenant liabilities and property reserves, as of the day before the date range of the report. For example, if the report has a date range of July 1 through July 31, then the beginning balance is as of June 30.

The beginning balance will represent a number other than $0 if you hold back money for a property reserve, are holding tenant liabilities, or if your reporting cycle differs from when you pay your rental owner. For example, if you pay a rental owner on the 4th of each month, a report run from the 1st through the 31st might not show a $0 beginning balance.

Instructions How to Run Owner Statement

- Go to the Reports menu

- Click the Rental Owner Statement link

- Select your report parameters. More details:

Click Download report!

Schedule a Consultation Now!

Be a Hero! PropertyWize Referral Program

Pick anyone and we’ll manage their property for 1 month for free and yours for free, too.

Owner Benefit Package

Minimize Your Exposure... and Headaches:

When a tenant defaults on the rent, it can take months to regain your property and get another tenant in place. Meanwhile, you're continuing to make mortgage payments and incurring additional expenses on the property, all the while losing rental income. Enter the Owner Benefit Package.

PropertyWize Realty

Enjoy Summer with our exclusive offer:

4.5% Commission on sales price.

* For any properties valued over 150K for current or former Property Management clients only.Interested in Selling Your Property? Contact us now at Sales@PropertyWizeRealty.com!

Log In to Owner's Portal

Copyright © 2024 PropertyWize, LLC, All rights reserved.

You are receiving this email because you are a current client of PropertyWize.

Our mailing address is:

PropertyWize, LLC

10 Gerard Ave Ste 203

Lutherville, MD 21093-3206

Add us to your address book

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

This email was sent to shanicka@propertywize.net

why did I get this? unsubscribe from this list update subscription preferences

PropertyWize, LLC · 10 Gerard Ave Ste 203 · Lutherville, MD 21093-3206 · USA

May 2024 Newsletter

|

|

April 2024 Newsletter

|

December 2024 Newsletter

Maximize your Returns: Invest with PropertyWize Realty

Did You Know?

We buy houses using private investors as our banks and share the profits with them. Our private investors get a fixed return through notes and mortgages secured by real estate. They can use funds from savings or even retirement accounts (IRA’s, 401(k), etc). It's a smart, secure, and profitable way to invest in the future of real estate.

Flat Roof Issues in Baltimore City: Preemptive Measures for Effective Repairs

As homeowners and property managers in Baltimore City, we understand the unique challenges of maintaining and repairing flat roofs, which have become a popular roofing solution due to their aesthetic appeal and space-saving characteristics.

Flat roofs, while visually striking, are particularly challenging in a city prone to extreme weather conditions. Issues such as water pooling, leaks, and material degradation can pose significant threats to the integrity of these roofs. Therefore, adopting preventive measures to address and forestall potential damages is imperative.

Common Challenges with Flat Roofs:

Pooling Water: Unlike pitched roofs, flat roofs lack a natural drainage slope, leading to water accumulation and ponding. In Baltimore's variable climate, with heavy rains and occasional snow, standing water can accelerate roof deterioration.

Leakage: Improper installation, aging materials, or damage from extreme weather can result in leaks. These leaks often manifest as water stains on ceilings or walls, threatening the building's structural integrity.

Material Degradation: Baltimore's weather, characterized by high humidity and temperature fluctuations, accelerates the degradation of roofing materials. UV rays, thermal expansion, and contraction further contribute to material breakdown over time.

Preventive Measures for Effective Repairs:

Regular Inspections: Conduct routine inspections, especially after extreme weather, to identify potential issues early. Check for cracks, tears, or blistering on the roof membrane.

Proper Drainage: Ensure efficient drainage by clearing debris from gutters, downspouts, and roof surfaces. Installing additional drainage systems or creating a slight slope can aid water runoff.

Quality Materials and Installation: Use high-quality roofing materials suitable for Baltimore's climate and ensure professional installation to mitigate premature deterioration.

Coatings and Sealants: Applying reflective coatings or sealants can prolong the roof's life, enhancing its resistance to weathering and reducing the impact of UV rays.

Timely Repairs: Address minor issues promptly before they escalate. This includes fixing small leaks, repairing damaged membranes, or replacing deteriorated sections.

Professional Maintenance: Engage roofing professionals for periodic maintenance. They can comprehensively assess the roof's condition and offer specialized repairs or treatments.

Recommended Annual Inspection and Replacement Schedule:

If your property has undergone roof repairs, we recommend an annual inspection costing $150.00. Also, we would suggest replacing flat roofs every three years, aligning with the standard warranty time frame.

In Baltimore City, flat roof maintenance requires a proactive approach to prevent issues and prolong the roof's lifespan. Regular inspections, prompt repairs, adequate drainage, quality materials, and professional maintenance are pivotal in preserving the integrity of flat roofs amidst the city's varying weather conditions. By implementing these preventive measures, property owners can mitigate the risk of extensive damages and ensure their flat roofs endure the rigors of Baltimore's climate for years.

From all of us at PropertyWize, we wish you & your family a joyful New Year! May this year bring you success, good health, and happiness.

From all of us at PropertyWize, we wish you & your family a joyful New Year! May this year bring you success, good health, and happiness.

Be a Hero! PropertyWize Referral Program

Pick anyone and we’ll manage their property for 1 month for free and yours for free, too.

For Referrals

Only applicable to first time customers. Property also must minimum standards and fully compliant of all state and local laws.

For Current Clients

To qualify, your account must be in good standing. Also only 1 property management fee credit is applicable up to a maximum of $150.00

Owner Benefit Package

Minimize Your Exposure... and Headaches:

When a tenant defaults on the rent, it can take months to regain your property and get another tenant in place. Meanwhile, you're continuing to make mortgage payments and incurring additional expenses on the property, all the while losing rental income. Enter the Owner Benefit Package.

PropertyWize Realty

Enjoy Winter with our exclusive offer:

5% Commission on sales price, along with a generous 30% rebate towards staging cost at closing. Say goodbye to admin fees too!

* For any properties valued over 150K for current or former Property Management clients only.

Interested in Selling Your Property? Contact us now at Sales@PropertyWizeRealty.com!

| Log In to Owner's Portal |

December 2023 Newsletter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 2023 Newsletter

|

|

|

|

|

|

|

|

|

|

|

|

September 2023 Newsletter

Pests & Property Management: Who's Responsible?

Pests can cause issues year-round, affecting property. Owners often think pest control is solely the tenant's problem. Maintaining a safe and habitable rental property is essential for landlords. Here's why:

Health and Safety: Pests like rodents can spread diseases and harm tenant health. Address pest issues promptly with professional help.

Property Damage: Termites, rodents, roaches, and ants can quickly damage your property. Act fast when you notice a problem to prevent extensive damage.

Tenant Satisfaction: A pest-free environment is the expectation of tenants. Neglecting pest control can lead to complaints and negative online reviews.

Lower Turnover: Pests drive tenants away. Failing to deal with the issue can result in frequent turnovers and ongoing pest problems.

However, owners should take it seriously to minimize property liability.

Tenant's responsibility:

For common pests like ants, mice, roaches, and spiders, tenants can help by maintaining basic hygiene:

Maintain cleanliness within the property, preventing food waste that might lure pests.

Remove pet food that attracts pests. If your pets have fleas, address the issue and consider preventive measures.

Keep garbage areas clean. Dispose of trash regularly and store it in tightly sealed outdoor containers.

Promptly inform your landlord if you discover or suspect pest activity.

Report any visible openings or exterior damage that could allow pests to enter the home.

Exercise care to avoid introducing pests from locations you've been to.

Owner's responsibility:

For rats, owners must act promptly. It's the owner's responsibility as per Baltimore's code. Neglecting this can result in fines or settlements, and importantly, it causes liability to property.

Best Practices for Property Owners

Here's how property owners can handle pest control effectively:

Regular Pest Control: Consider quarterly or semi-annual pest control to prevent major infestations.

Address Problem Areas: Fix areas that attract pests, like standing water for mosquitoes.

Professional Pest Control: When in need, listen to property management professionals and use professional pest control services.

Cost vs. Risk: Weigh the costs of pest control services against losing good tenants or facing legal problems.

See the attached link for our recommendations for tenant and owner responsibility as per the sort of the house.

Coming Soon: The Resident Benefit Package!

We are thrilled to announce an exciting new initiative that will enhance the living experience for both you and your tenants. Introducing the Resident Benefit Package!

It is designed to elevate your tenant’s living experience to create a competitive advantage for property owners. Offering these benefits to residents will improve tenant satisfaction and retention, while also making your property more appealing to prospective residents. A win-win for everyone involved.

Stay tuned for more details. Your property's success is our priority!

|

Be a Hero! PropertyWize Referral ProgramPick anyone and we’ll manage their property for 1 month for free and yours for free, too. For Referrals For Current Clients |

|

|

|

|

August 2023 Newsletter

|

|

|

|

|

|

|

|

|